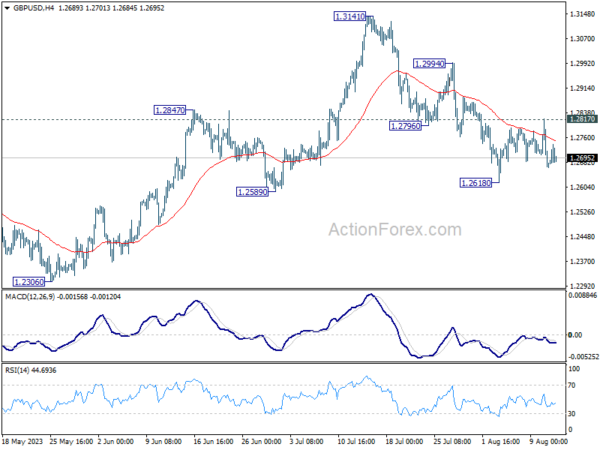

GBP/USD’s restoration final week was barely stronger than anticipated, however it will definitely settled again in established vary. Preliminary bias stays impartial this week. On the draw back, beneath 1.2618, and sustained buying and selling beneath 1.2678 resistance turned help will argue that it’s already in a bigger correction. Deeper decline would then be seen to 1.2306 help subsequent. Nonetheless, agency break of 1.2817 minor resistance will point out that the pull again has accomplished, and switch bias again to the upside for stronger rebound.

Within the larger image, a medium time period prime might be in place at 1.3141 already, on bearish divergence situation in D MACD. Sustained buying and selling beneath 55 D EMA (now at 1.2725) ought to verify this case, and convey deeper fall to 38.2% retracement of 1.0351 to 1.3141 at 1.2075, as a correction to up pattern from 1.0351 (2022 low). For now, rise will keep mildly on the draw back so long as 1.3141 resistance holds, in case of robust rebound.

In the long run image, sustained buying and selling above 55 M EMA (now at 1.2902) will add to the case of long run bullish reversal, and goal 1.4248 cluster resistance (38.2% retracement of two.1161 (2007 excessive) to 1.0351 at 1.4480) for affirmation. Nonetheless, rejection by 55 M EMA will preserve long run bearishness for draw back resumption at a later stage.