FOMC DECISION – MARCH MEETING

- The Federal Reserve leaves rates of interest unchanged on the finish of its March assembly, in step with expectations

- The 2024 coverage outlook stays the identical, with the Fed nonetheless signaling 75 foundation factors of easing for the yr

- Gold costs head increased because the U.S. greenback and yields take a flip to the draw back

Most Learn: UK Inflation Falls to a Two-12 months Low, GBP/USD Steady for Now

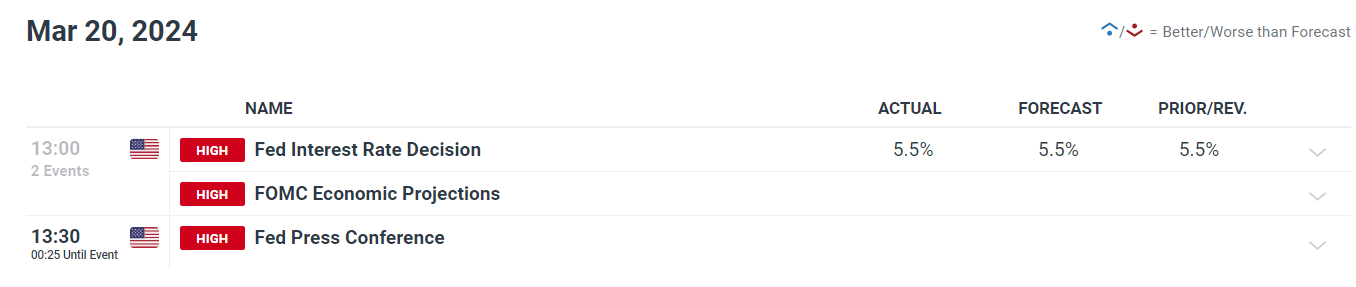

The Federal Reserve on Wednesday left its benchmark rate of interest unchanged at its present vary of 5.25% to five.50% after concluding its March coverage gathering, holding borrowing prices on maintain for the fifth consecutive assembly, in step with consensus estimates. As well as, policymakers made no changes to their ongoing quantitative tightening program, simply as anticipated.

Specializing in the assertion, the Fed maintained an upbeat view of the economic system, noting that macroeconomic indicators counsel exercise has been increasing at a stable tempo and that the unemployment fee stays low. Turning to shopper costs, the central financial institution reiterated that inflation has eased over the previous yr, however persists at elevated ranges.

When it comes to ahead steerage, the FOMC restated that it doesn’t count on it will likely be acceptable to take away coverage restrain till it has gained larger confidence that inflation is converging sustainably towards the two.0% goal. This message, echoing January’s communication, suggests officers are in search of further reassurance on disinflation earlier than pivoting to a looser stance.

Supply: DailyFX Financial Calendar

Questioning in regards to the U.S. greenback’s prospects? Achieve readability with our newest forecast. Obtain a free copy now!

FED SUMMARY OF ECONOMIC PROJECTIONS

GDP, UNEMPLOYMENT RATE AND CORE PCE

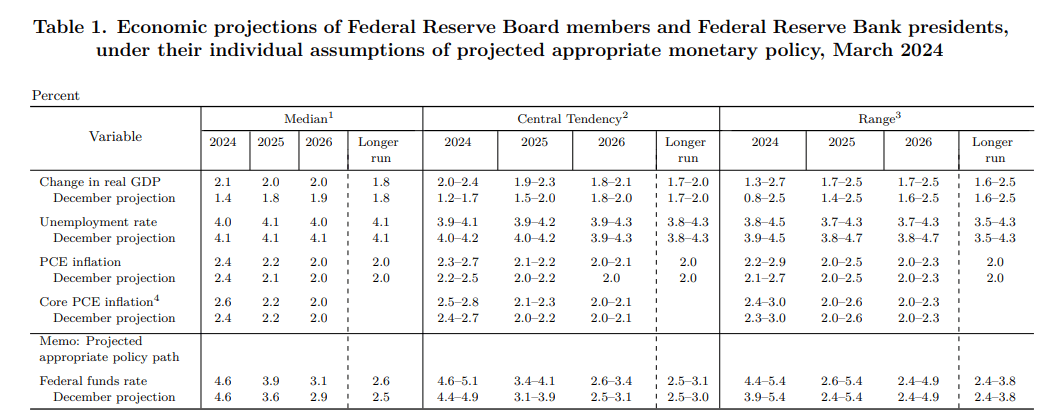

The March Abstract of Financial Projections revealed essential revisions in comparison with the quarterly estimates submitted in December of final yr.

First off, GDP development projections for 2024 had been upgraded to 2.1% from 1.4% beforehand, pointing to elevated confidence within the economic system’s resilience and its capability to keep away from a recession.

Turning to the labor market, the outlook for the unemployment fee for this marked right down to 4.0% from 4.1%, suggesting the Fed does not anticipate widespread layoffs over the medium time period.

On the inflation entrance, the Fed revised upwards its 2024 forecast for the core PCE deflator to 2.6% from the earlier 2.4%, an indication that worth pressures are anticipated to stay sticky for an prolonged interval.

FED DOT PLOT

The dot plot, outlining Federal Reserve officers’ expectations for the trajectory of rates of interest over a number of years and the long term skilled notable adjustments in comparison with the earlier model offered three months in the past.

Again in December, the Fed projected borrowing prices to finish 2024 at 4.6%, suggesting three quarter-point fee cuts for a complete easing of 75 foundation factors. At present’s iteration exhibits the identical outlook, indicating policymakers is probably not overly anxious about firming inflationary pressures simply but.

Waiting for 2025, officers see charges falling to three.9%, barely above the beforehand forecasted 3.6%.

As well as, the central financial institution raised its projection for the long-run federal funds fee from 2.5% to 2.6%, maybe reflecting structural shifts in productiveness or enduring worth pressures. This adjustment is barely hawkish, however markets seem extra involved in regards to the near-term outlook for now.

The next desk gives a abstract of the Federal Reserve’s up to date macroeconomic projections.

MARKET REACTION AND IMPLICATIONS

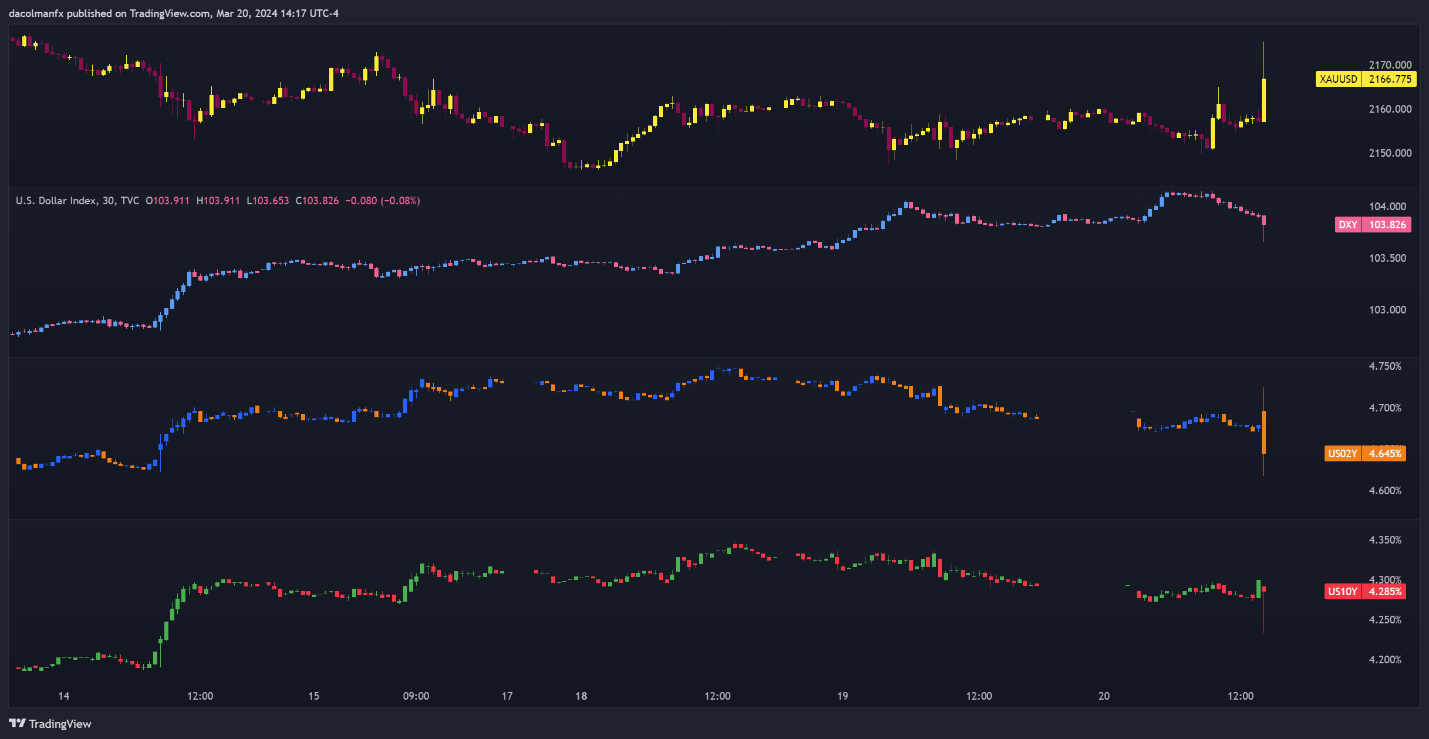

Shortly after the Fed’s resolution was introduced, gold costs pushed increased, propelled by the pullback within the U.S. greenback and yields. The indication that the Fed remains to be intent on delivering three quarter-point fee cuts this yr is having a bearish impact on the dollar on the time of writing. For a clearer understanding of the Fed’s financial coverage outlook, nevertheless, merchants ought to attentively monitor Chairman Powell’s press convention. In any case, immediately’s response might nonetheless reverse given the upside revision to the long-term equilibrium fee.

US DOLLAR, YIELDS AND GOLD PRICES CHART

Supply: TradingView

DailyFX gives foreign exchange information and technical evaluation on the developments that affect the worldwide forex markets.