US Greenback (DXY), Treasuries Information and Evaluation

- US CPI knowledge in focus as a possible re-acceleration in costs positive aspects traction

- USD eases forward of CPI – bullish outlook nonetheless constructive

- Treasury yields development greater suggesting USD might need to play catch up if we see hotter knowledge

- Elevate your buying and selling abilities and achieve a aggressive edge. Get your fingers on the U.S. greenback Q2 outlook right now for unique insights into key market catalysts that ought to be on each dealer’s radar:

US CPI Knowledge in Focus as a Potential Re-acceleration in Costs Positive factors Traction

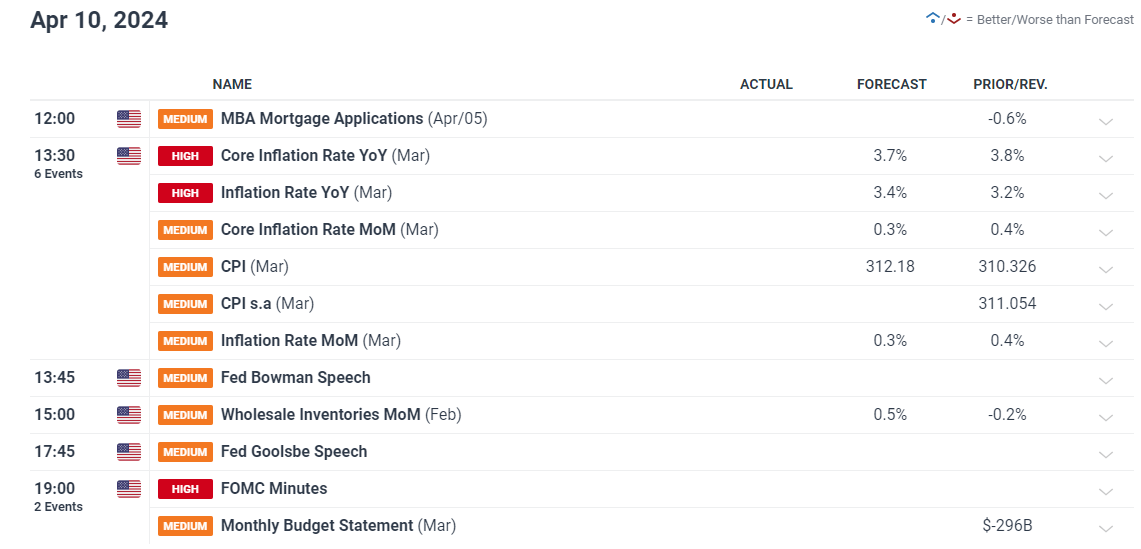

Tomorrow, US CPI knowledge is prone to garner a lot consideration, particularly after latest, key shorter-term measures of inflation counsel worth pressures could also be re-accelerating. Shorter-term measures of inflation, such because the month-on-month comparisons, have revealed a stubbornness in getting inflation all the way down to 2%.

Spectacular US knowledge has additionally helped contribute to the dearth of progress on the inflation entrance, with US GDP anticipated to be 2.5% in line with the Atlanta Fed’s GDPNow forecast and final week’s jobs report revealed a large shock of a further 300ok jobs added in March.

Customise and filter reside financial knowledge through our DailyFX financial calendar

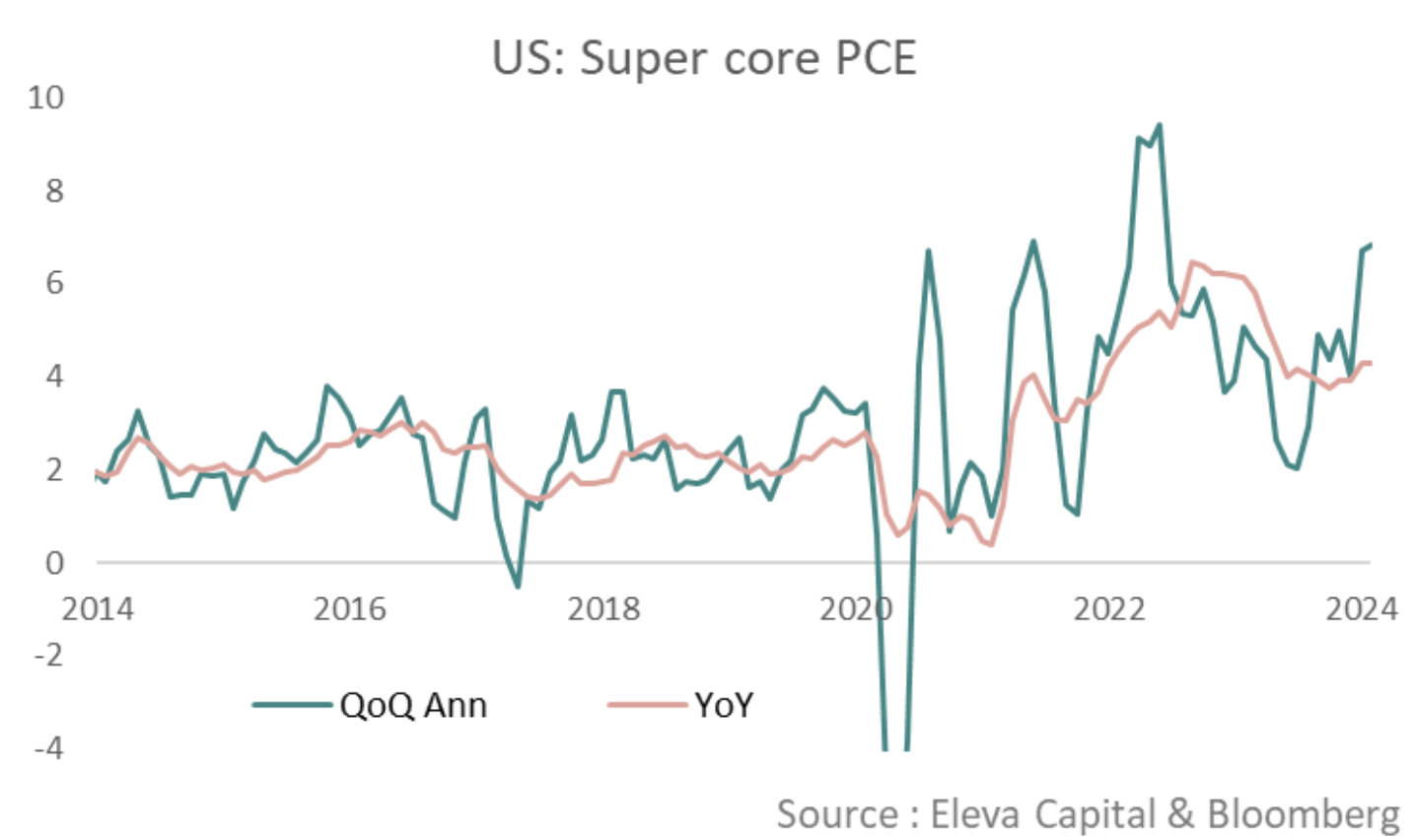

Nevertheless, the general disinflationary narrative is changing into tougher to inspire, given the rise in present, shorter-term worth knowledge. The Fed has usually cited a measure of inflation known as ‘tremendous core’, which includes of companies inflation much less vitality and housing. This measure strips out unstable gadgets like gas and removes the impact of housing knowledge which tends to have a large lag.

Tremendous core has been rising quicker (MoM) than the year-on-year knowledge for six months now and is beginning to resemble what we noticed again in 2022 when costs had been on the rise.

US Tremendous Core Accelerating within the Shorter-Time period

Supply: Stephane Deo through X, Eleva Capital & Bloomberg

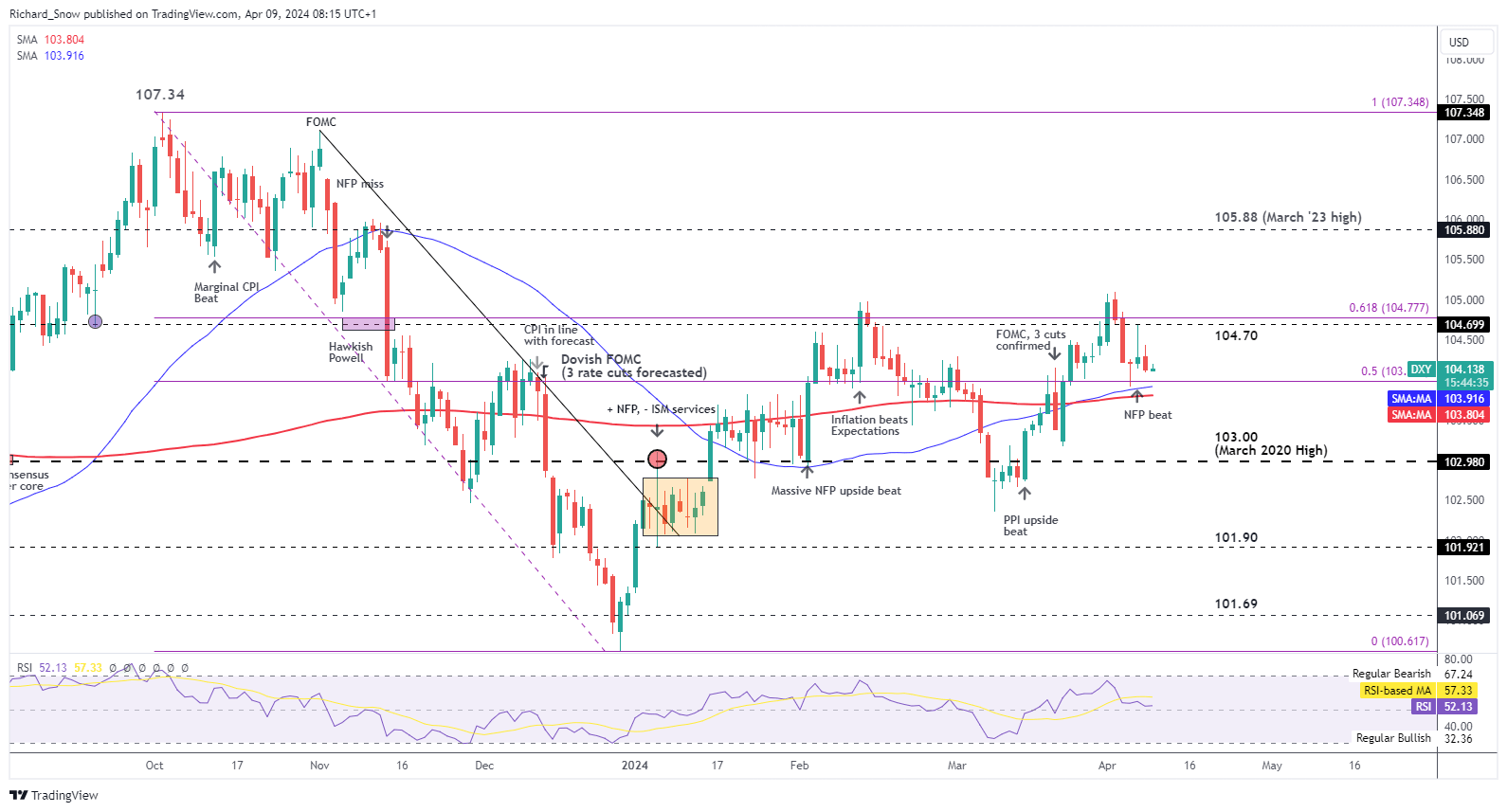

USD Eases Forward of US Inflation Knowledge – Bullish Outlook Nonetheless Constructive

The US greenback (through proxy DXY) has been on the decline in April, other than April Idiot’s Day. It have to be famous that almost all of the US greenback basket is comprised of the EUR/USD pair and the latest elevate in confidence/sentiment surveys within the EU has added to the view that issues are trying up within the EU.

DXY finds help presently on the 50% Fibonacci retracement of the 2023 decline, with the 50 and 200-day easy transferring averages (SMAs) reinforcing that basic space. Subsequently, ought to inflation knowledge shock, or just stay sturdy, there may be potential for the greenback to rise within the aftermath of the report. That is backed up additional by rising US treasury yields (2- yr and 10-year). The bullish posture holds as costs commerce above the 50 SMA, and the 50 SMA is above the 200 SMA – which suggests a bullish setup.

Resistance seems at 104.70 adopted by the swing excessive of 105.

US Greenback (DXY) Day by day Chart – 9 April 2024

Supply: TradingView, ready by Richard Snow

Searching for actionable buying and selling concepts? Obtain our prime buying and selling alternatives information filled with insightful ideas for the second quarter!

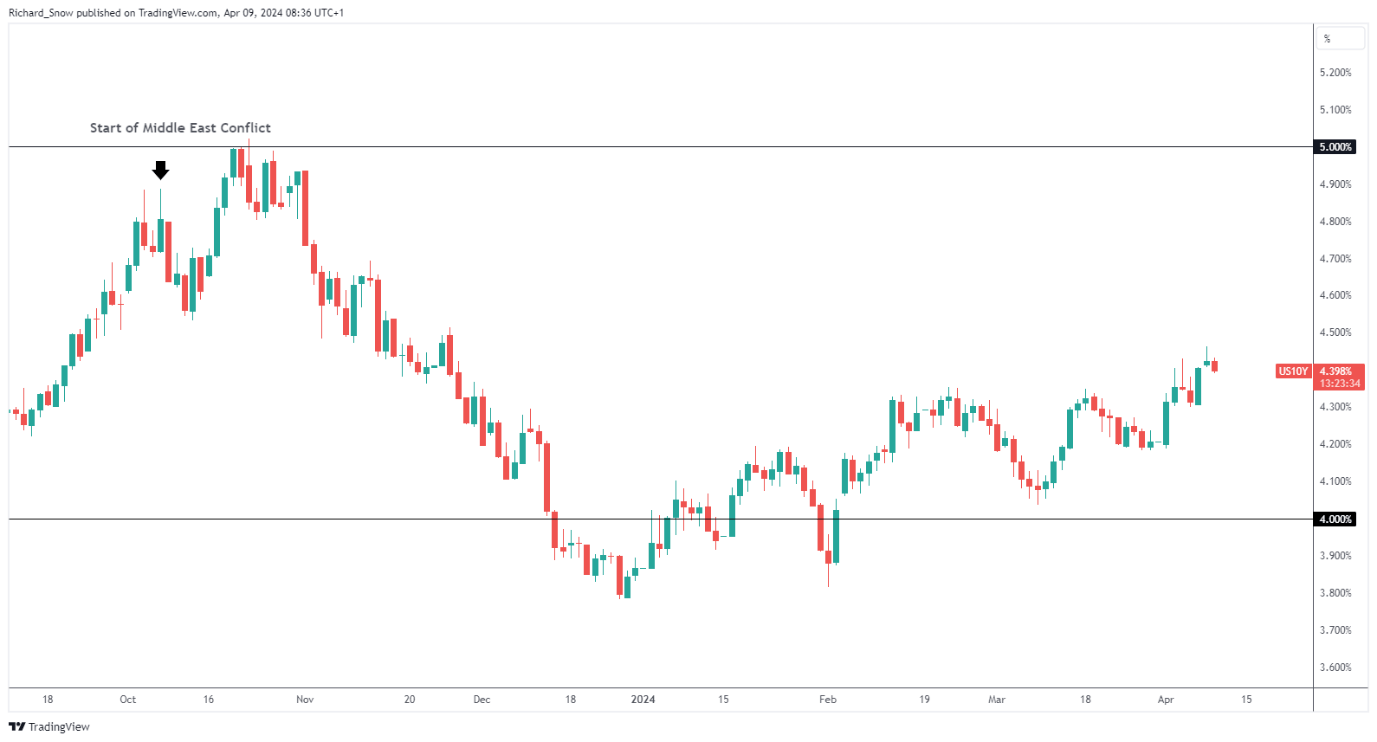

Treasury Yields Pattern Greater

US Treasury yields have maintained the longer-term uptrend as sturdy US knowledge continues to decrease expectations of aggressive fee cuts materialising in 2024. Markets have even began to entertain a better probability of that first fee lower solely coming by means of in July, as an alternative of June. As well as, the market is pricing in the opportunity of solely two cuts this yr versus the Fed’s three, one thing that should hold the greenback supported.

US Treasury Yields (10-12 months) – 9 April 2024

Supply: TradingView, ready by Richard Snow

Keep updated with the most recent breaking information and themes by signing as much as the DailyFX weekly e-newsletter:

— Written by Richard Snow for DailyFX.com

Contact and observe Richard on Twitter: @RichardSnowFX

DailyFX gives foreign exchange information and technical evaluation on the traits that affect the worldwide forex markets.