US NONFARM PAYROLLS – USD/JPY, GOLD

- The U.S. greenback and gold costs might be very delicate to the upcoming U.S. jobs report

- Market expectations counsel the U.S. economic system created 200,00Zero payrolls in March

- Robust job development must be optimistic for the U.S. greenback however bearish for gold costs

Most Learn: Decoding Fedspeak: How Central Banker Feedback Transfer Markets – Gold & US Greenback

Buyers might be on edge on Friday because the U.S. Bureau of Labor Statistics is scheduled to launch its newest nonfarm payrolls report. This carefully watched financial survey holds vital sway over market sentiment, particularly in relation to the Federal Reserve’s financial coverage trajectory.

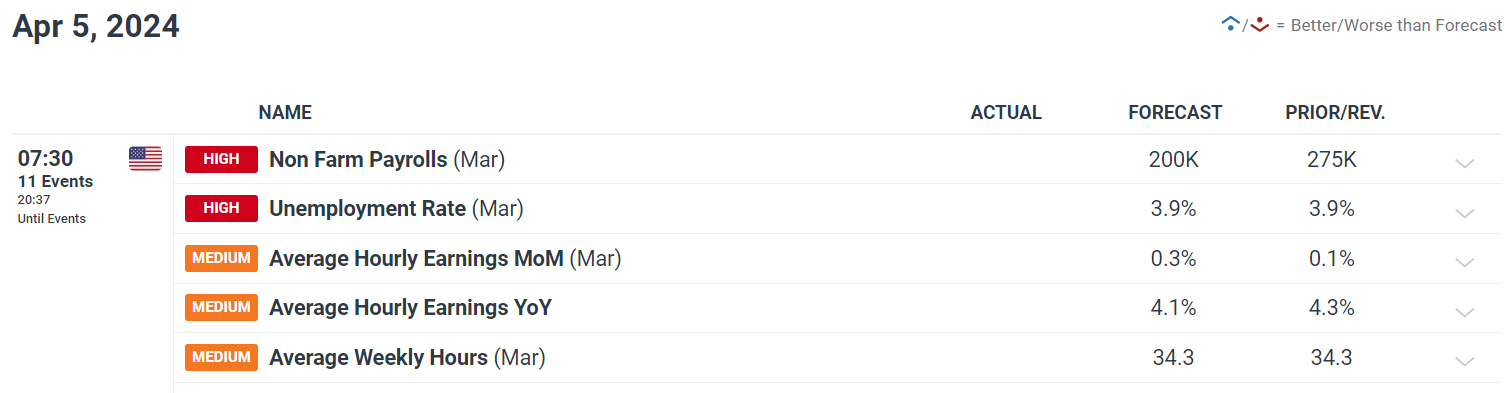

By way of consensus estimates, economists anticipate a moderation in job development, forecasting the addition of 200,00Zero new jobs in March. This marks a slowdown in comparison with February’s sturdy 275,00Zero added positions. The unemployment charge is predicted to stay unchanged at 3.9%.

Specializing in pay features, common hourly earnings are projected to extend by a modest 0.3% month-over-month, bringing the yearly studying right down to 4.1% from 4.3% beforehand, probably easing a number of the Fed’s issues a couple of wage-price spiral reinforcing already elevated costs pressures within the economic system.

If you’re discouraged by buying and selling losses, why not take a proactive step to enhance your technique? Obtain our information, “Traits of Profitable Merchants,” and entry invaluable insights to help you in avoiding frequent buying and selling errors.

Navigating the Potential Market Reactions

How the markets reply to the NFP knowledge will largely depend upon whether or not the numbers exceed or fall wanting expectations:

Robust Report: A surprisingly sturdy jobs report may sign a resilient economic system, main the U.S. central financial institution to carry off on plans to ease rates of interest imminently. This state of affairs must be bullish for the U.S. greenback, however is more likely to put downward strain on valuable metals like gold and silver.

Weak Report: A disappointing NFP launch may point out a cooling labor market. This might bolster market expectations for earlier rate of interest cuts by the Fed, strengthening the case for a June transfer. Such a growth may result in a weaker U.S. greenback, offering potential help for gold and silver costs.

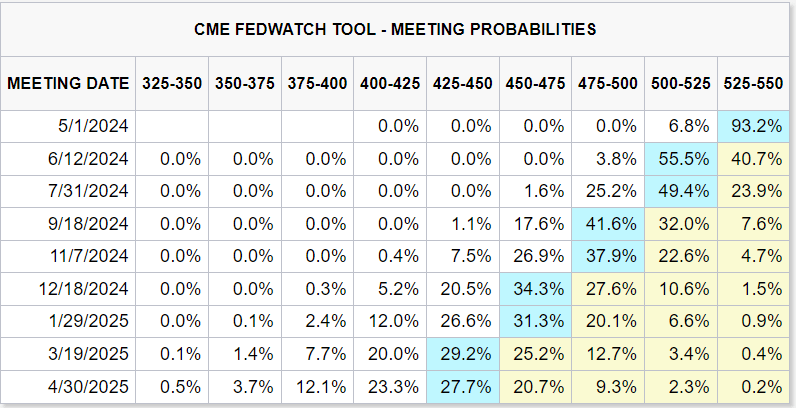

The desk beneath present FOMC assembly possibilities as of Thursday morning.

Supply: CME Group

Past the Headline Numbers

Merchants must fastidiously study the report’s particulars for clues about underlying developments within the labor market. Key components to observe embody:

Participation Fee: A rise within the labor drive participation charge suggests extra individuals are coming into the job market, a optimistic signal for the economic system.

Revisions to Earlier Months: Pay shut consideration to any revisions within the jobs knowledge from prior months, as these can affect market reactions.

Put together for Volatility

Merchants ought to brace for probably sharp value actions and market volatility instantly following the NFP launch. For that reason, you will need to make use of sound danger administration methods and keep away from making impulsive selections primarily based solely on this one knowledge level. Contemplate the report’s findings within the context of broader macroeconomic developments and the newest signaling from the Federal Reserve.

Wish to know the place the U.S. greenback could also be headed over the approaching months? Discover key insights in our second-quarter forecast. Request your free buying and selling information now!

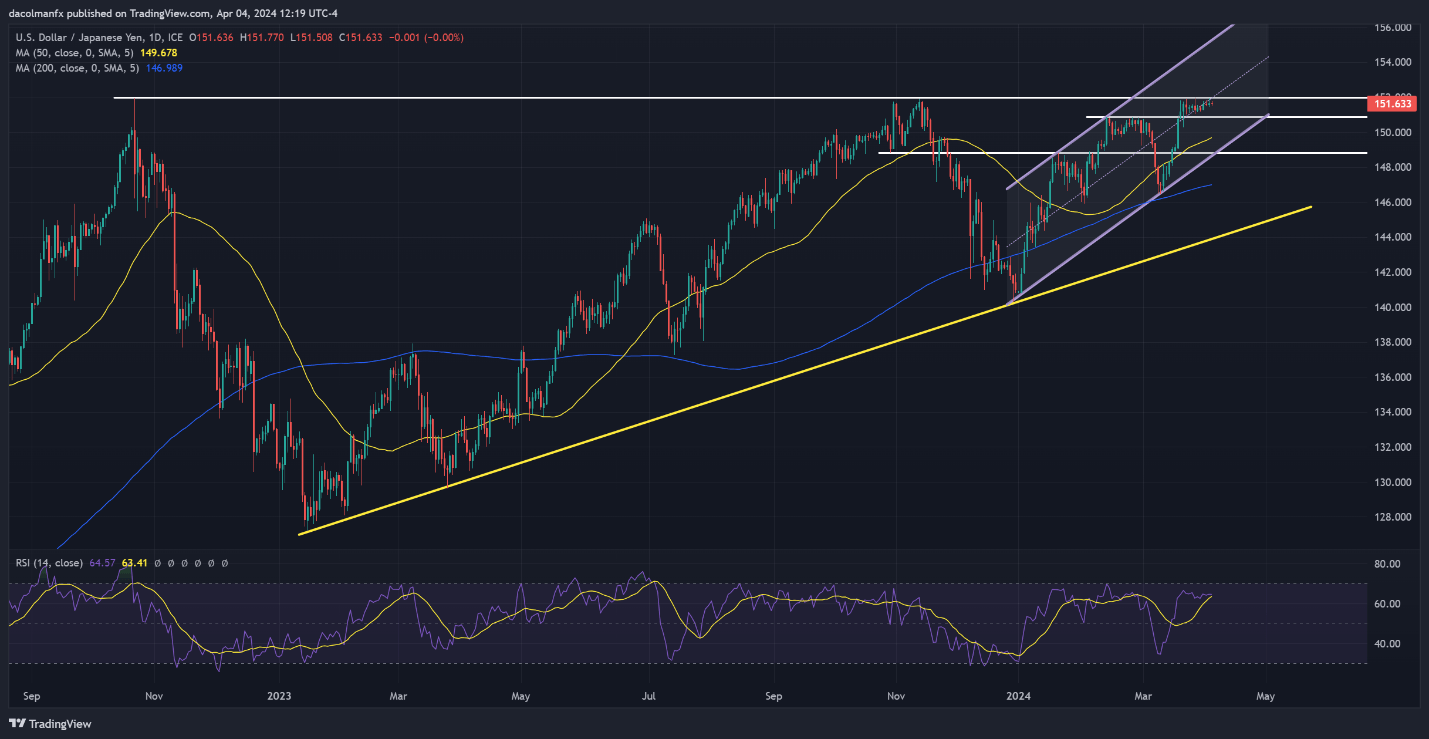

USD/JPY FORECAST – TECHNICAL ANALYSIS

USD/JPY traded inside a confined vary on Thursday, lingering slightly below overhead resistance at 152.00. This technical barrier warrants shut consideration, as a breakout may immediate intervention from the Japanese authorities to help the yen. Ought to such a state of affairs unfold, a speedy reversal beneath 150.90 may happen forward a attainable drop in direction of the 50-day easy transferring common at 149.75.

Within the occasion that USD/JPY takes out the 152.00 degree and Tokyo refrains from intervening, opting as a substitute to permit market forces to discover a new equilibrium for the trade charge, consumers may achieve confidence to launch a bullish assault on 155.25, a key barrier created by the higher boundary of an ascending channel in place since December of final yr.

USD/JPY PRICE ACTION CHART

USD/JPY Chart Created Utilizing TradingView

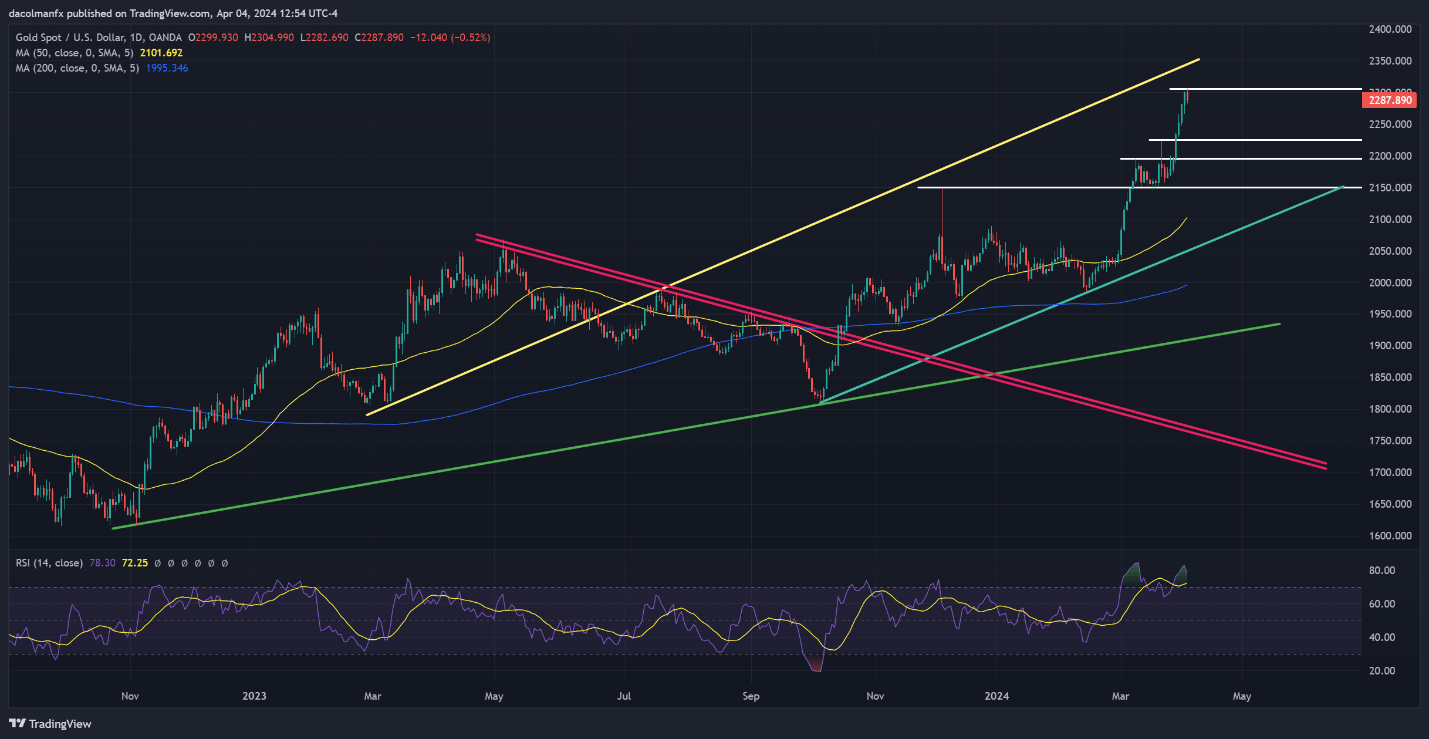

GOLD PRICE FORECAST – TECHNICAL ANALYSIS

After briefly touching an all-time excessive through the in a single day session, gold costs retreated on Thursday, stepping again from the $2,305 threshold. Ought to downward strain persist, help is scarce till the $2,225, implying the potential for a big retracement within the occasion of a breakdown earlier than any indicators of stabilization seem.

Conversely, ought to bulls reclaim agency command of the market, resistance awaits at $2,305, as beforehand famous. In case of a breakout, costs would enter uncharted territory, making it difficult to pinpoint potential resistance ranges. Nonetheless, a notable space of curiosity might lie at $2,345, similar to an ascending trendline originating from the lows of March 2023.

Keen to realize insights into gold’s future path? Uncover the solutions in our complimentary Q2 buying and selling forecast. Request a replica now!

GOLD PRICE-ACTION CHART

Gold Worth Chart Created Utilizing TradingView

DailyFX offers foreign exchange information and technical evaluation on the developments that affect the worldwide forex markets.